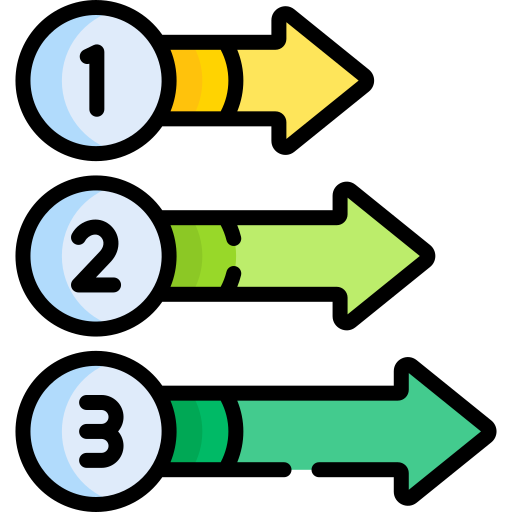

Take only these simple 3 steps to overcome the difficulties businesses face when integrating separate payment gateways into their websites and systems.

Onboarding Process

OneGate

OneGate API is the interface for a payment processing engine that runs behind a dedicated system. The only integration required for businesses is to connect their website to our API and send customer and order details. Our payment processing system aims to overcome the difficulties businesses face when integrating separate payment gateways into their websites and systems, such as:

- Manage your orders and fulfillment in one place.

- Reduce the barriers to online business and make commerce better for everyone.

In 3 Steps

1. Application

Businesses are required to complete our OneGate application form to register with our High-Risk services. Based on the business details and the risk, we will contact our exclusive PSP providers for suitable payment methods for the business. Application Link: (Click Here)

2. Approval

Upon receiving your application, our compliance team will review your business/website to assess the risk and details and will contact payment service providers with your details to set up your account on their platforms. This process takes a minimum of 3 -5 days.

3. Integration

After the approval and account setup, our technical team will contact you in regards to integration. As a high-risk merchant, OneGate API will do more security measures to reduce the risk of disputes, chargebacks, and frauds.

Our 24/7 techies will help you at any time with any inquiry.

Final Step :

OneGate.network is a tech provider that focuses on payment processing and API integrations to provide an easy solution for merchants to accept payments from customers. For merchants who need to start processing quickly, gateway integration would be a bottleneck.

Integration, Testing, and Security are more of tech works where our team comes in handy. As our team specializes in API integrations and payment handling, using our service would benefit merchants in many ways.

Benefits

- Secure Merchant & Customer data;

This method is used to store and transfer relevant transaction details of Merchant and Customer by an encrypted form to keep details secure.

- Data Screening for suspicious requests;

We check and monitor provided customer details to reduce fake data transferring, 3rd party accesses, and any unauthorized activity to block the relevant transaction for safety.

- VPN/Proxy filtering;

Using VPN/Proxy filtering methods can reduce fake data submissions, 3rd party accesses, and any unauthorized sign-in to the relevant transaction process.

- IP, Geo data validation;

By validating IP Address, Geo Data, we can securely monitor and cancel the fake customers and their activities during the transaction process.

- VPN/Proxy filtering;

Using VPN/Proxy filtering methods can reduce fake data submissions, 3rd party accesses, and any unauthorized sign-in to the relevant transaction process.

- Dispute handling and resolution;

We worked closely with the merchant to manage, reduce and handle those disputes, charge backs handling, and resolution according to the merchant’s flavor.

Usage

API for any Business

APIs provided by payment service providers — such as Paypal, Skrill, Banks (credit card), etc. — allow developers to access their functionality and process transactions. However, the API (Application Programming Interface) and the steps to connect to each payment provider are different and inconsistent. Also, adapting to new releases of API with updated functionality and security is required continuous development and maintenance.

We at OneGate give programmers the ability to connect their applications/websites with external payment providers via our API, which is standard to any provider they are trying to connect. Also, our payment engine handles all the differences and continues updates by OneGate Team. We help businesses to speed up their development and cut costs for integrating different payment services and maintenance required.

High-Risk Merchants

We support Normal and High-Risk businesses for accepting payments from their customers. For High-Risk Merchants, we are integrated with PSP providers who offer alternative local bill payment methods, which customers are familiar in their countries.

OneGate as an intermediate layer, we work with our exclusive PSP providers to mitigate risk to businesses and customers in the high-risk category. OneGate system performs IP-based filtering, Proxy / VPN filtering, Validation over customer geographic information against the data they enter to complete the payment. The level of security can be configured for each business from the onegate business dashboard.

OneGate Pricing

As in OneGate official website, the pricing of the API Integration is under three main categories. Those are;

- Number of Transactions 100 & 0.25$ per exceeding transaction.

- Number of Transactions 500 & 0.20$ per exceeding transaction.

- Number of Transactions 1000 & 0.15$ per exceeding transaction.

Based on the number of transactions, you can get the individual plan for your business.